The next Apple-Samsung battle will be fought over graphene, not in the courtroom

By Sebastian Anthony on May 19, 2014 at 2:34 pm | From:http://www.extremetech.com/

As one of the larger Apple-Samsung court cases wraps up, it appears the next big battle for mobile computing supremacy might take place in the laboratory instead. With most of the crazy smartphone and tablet growth now behind us, and with little to be gained from continued patent spats, both Apple and Samsung are now looking to bleeding-edge graphene research to spearhead development of faster, stronger, more efficient, and flexible mobile devices. While Apple has historically led when it comes to manufacture and design, Samsung undoubtedly has a massive advantage when it comes to researching new materials and technologies. Will mastery of the miraculous material be what Samsung finally needs to take the mobile computing lead from Apple?

According to a new report from Bloomberg, which did some probing into patents and graphene research groups, Apple, Samsung, and Google are in a “race” to acquire the patents and other intellectual property that will allow for the use of the material in mobile devices and wearables. With the global mobile market expected to reach $847 billion by 2016, there’s an awful lot of money at stake — and so far, it seems Samsung is winning.

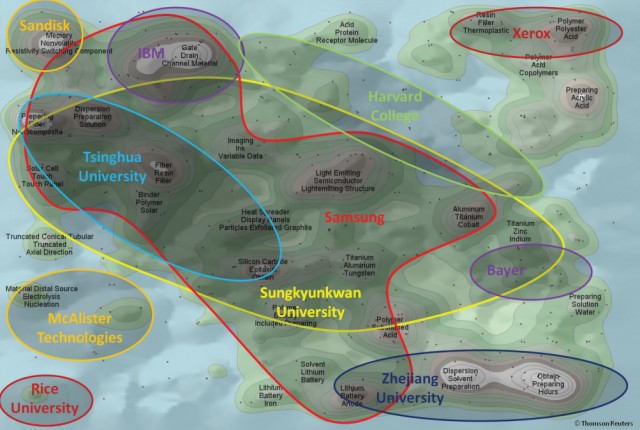

In 2013, the UK Intellectual Property Office published the authoritative report on the current state of graphene-related patents — and thus by extension, a pretty good measure of which companies are plowing the most time and dollars into graphene research. The leader, by a huge margin, is Samsung with 405 worldwide patent applications, spanning 210 patent families for graphene-related inventions/discoveries. Samsung also has tight ties with Sungkyunkwan University, the second largest graphene patent holder. The next big name is IBM, with just 64 patent families, and then other players like Xerox, Fujitsu, and SanDisk with around 30. Apple and Google are nowhere to be found. Beyond the corporate players, most of the patents are actually being filed by universities in Asia, with China rapidly accelerating to become one of the main players in the last two years.

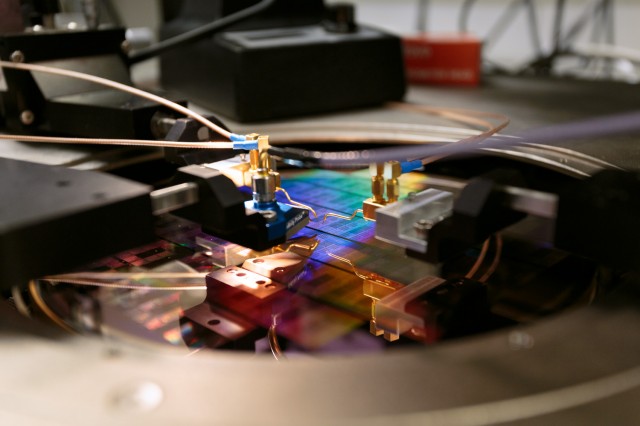

Of course, while having lots of graphene patents is nice, the main thing is having the rightpatents. According to the UK IPO report, the surge in Chinese patent applications is due to “Chinese universities are searching for the ‘major’ breakthrough that will allow industrial quantities of graphene to be produced for global commercialisation.” In the diagram below, you can see most of the key areas of graphene research, and where each big player in graphene is focusing its research. While IBM is clearly only interested in graphene transistors, and SanDisk is only interested in graphene memory, Samsung is unique in that it’s plowing millions of dollars into almost every area of graphene research. Samsung doesn’t want just one key graphene patent — it wants them all. It wants to find the secret to mass-producing commercial graphene, and then the processes for turning that graphene into terahertz computer chips, flexible displays, ultra-powerful batteries, and more.

Where does this leave Apple and Google? Neither company has historically had strong R&D departments. Google is slowly getting up to speed, but it’s still a very young company compared to IBM or Samsung. Following the iPhone and iPad, Apple has stepped up its research into wireless tech, to try and compete with the likes of Qualcomm and Nokia on next-gen cellular standards — but when it comes to chemistry and materials science, it barely registers. It’s not all bad though: Despite the smaller R&D budgets, both Google and Apple are doing fine — they just approach the problem from a different angle. While IBM and Samsung work from the ground up, Apple and Google are much more about selling products. Samsung wants to make the graphene and graphene chips — Apple wants to make the product that uses a graphene chip or flexible graphene display to make another 100 billion dollars.

I’m sure Apple and Google would love to have a horse in the graphene research war, but it’s just not how either company is designed to operate. It is much more likely that it will simply acquire the necessary IP, rather than fighting it out in the trenches. (If you have some extra time, I strongly recommend looking at the graphs and diagrams in the UK IPO’s graphene report. There’s some fascinating data in there.)